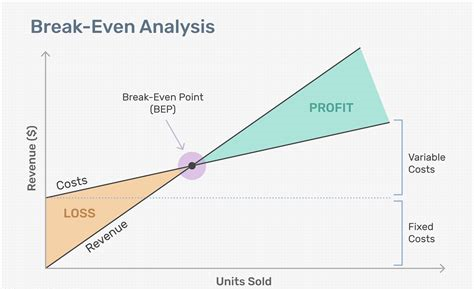

Break-even is the point when income matches expenses. Knowing your break-even point shows how much revenue you need to equal and surpass expenses. To determine your break-even point, you need to understand a few terms.

Fixed costs are the costs that do not change no matter how much revenue you earn. Items like rent, utilities, management and administrative wages, and insurances are considered fixed costs.

Variable costs are those that are directly related to the products or services you sell. They include raw materials, direct labor (manufacturing labor or service labor), and the cost of items purchased for resale.

Contribution Margin is calculated by subtracting variable costs from revenues.

Break-even = Fixed Costs/Contribution Margin

Below are three examples of break-even analysis for different types of business.

Manufacturing company:

Fixed costs = $60,000 per month

Variable costs = 30%

Sale price per item = $50

Contribution margin = $50 – 30% = $50 – $15 = $35

Break-even = 60,000/35

= 1,715 items or $85,714.50 in sales

This company needs to sell 1,715 items per month at $50 each to break even.

Restaurant:

Fixed costs = $9,000 per month

Variable costs (food) = 40%

Average bill per person = $50

Contribution margin = $50 – 40% = $50 – $20 = $30

Break-even = $9,000/30

Break-even = 300

The restaurant must serve 300 people in a month to break even. That equals about 10 people per day.

Service provider:

Fixed costs = $4,000 per month

Variable costs (labor) = 50%

Sale price per hour = $100

Contribution margin = $100 – 50% = $50

Break-even = 4000/50

Break-even = 80 hours of services sold or $8,000

This service provider needs to sell 80 hours of services each month to break even.

Why is break-even analysis so important?

1. Knowing your break-even helps you determine if a business can be profitable. If you need to charge $100 per unit to cover your fixed and variable costs but competitors are charging an average of $60 per unit for similar items, you know you are not going to be successful with this set of circumstances. But if your products are better quality and justify the higher price, then it could work.

2. Determining your break-even forces you to consider all your variable and fixed costs. A manufacturer might be able to negotiate better prices for raw materials; a restaurant might consider other sources for food, you might need to reduce the number of employees, or you might need to shop around for lower insurance premiums.

3. Knowing your break-even point can help you discover the items/services that bring the highest profits. Doing a break-even analysis for the individual items you sell will show you where you make the most money. Sometimes it will tell you if you need to eliminate certain items or services.

4. Similarly, a break-even analysis will help you decide if a new product or service will be profitable.

5. Break-even analysis is necessary if you want to attract investors. This shows investors that you understand your business numbers and will help you substantiate any claims you make about profitability.

A break-even analysis should be done for every business at least once per year, along with a market analysis. Cost increases in materials, labor, rent, insurances are a given. Any needed sales price changes can be determined by looking at the break-even, along with considering competitors’ pricing.

A good accountant should be able to work with you on your break-even analysis. If your accountant does not provide one, ask for it!